Procedimiento anticelulítico para vientre delgado primer plano de cinta de kinesiología en el concepto de corrección de diástasis de barriga femenina | Foto Premium

Gel crema adelgazante reductora anticelulitica reafirmante potente hombre mujer. Quemagrasas abdomen caderas y glúteos, anti celulitis intensivo efecto frio : Amazon.es: Belleza

Máquina de adelgazamiento para mujeres, cinturón de masaje Abdominal, masajeador anticelulítico, quemador eléctrico de grasa del vientre, masajeador corporal, eliminación de grasa - AliExpress

Amazon.com: Crema abdominal, crema para esculpir abdominales, crema quemadora de grasa, gel de masaje de crema caliente anticelulítico para apretar la piel, crema reafirmante para entrenamiento, crema potenciadora del sudor para barriga,

Ofertaaa!!!!!! 3 Corsario Reductor Shapecell Sport (1 gris, 1 azul, 1 rojo) HEVET Shape cell + 1 Jabón anticelulitico + 1 Cepillo masaje anticelulitico!!!!! • Compre Medias

Crema muscular Abdominal potente para hombres, producto anticelulítico para quemar grasa, pérdida de peso, 60ml - AliExpress

Gel crema adelgazante reductora anticelulitica reafirmante potente hombre mujer. Quemagrasas abdomen caderas y glúteos, anti celulitis intensivo efecto frio : Amazon.es: Belleza

Gel grasa del vientre | Crema reafirmante barriga 1.05 oz - Crema tensora barriga y estómago Gel anticelulítico Fórmula suave no irritante para brazos Pratvider : Amazon.es: Belleza

Nuevo ungüento abdominal para hombres Sudor Anticelulítico Adelgazante Reafirmante Six Pack Abs culturismo | Fruugo ES

Crema muscular Abdominal potente para hombres, producto anticelulítico para quemar grasa, 80g, paquete de ocho - AliExpress

Kinesiology Tapingkinesiology Tape To Patient Belly Procedimiento Anticelulítico Para Barriga Delgada Y Caderaseliminación De Celulitis Concepto De Recuperación Concepto De Pérdida De Peso Foto de stock y más banco de imágenes de

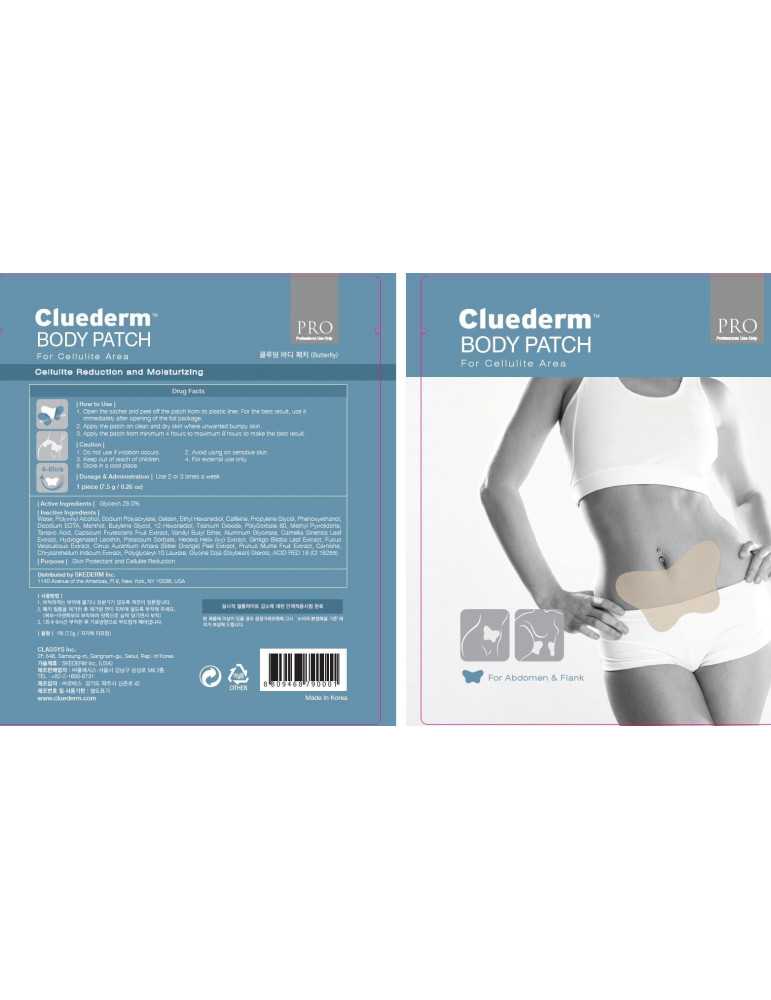

Parches Adelgazantes Efectivos,Parches Para Adelgazar, Slim PatchParche de Adelgazamiento Rápido Anticelulítico y Quemagrasas para Barriga de Cerveza, Cintura de Grasa del Vientre : Amazon.es: Belleza

Crema muscular Abdominal potente para hombres y mujeres, producto anticelulítico fuerte para quemar grasa, pérdida de peso, nueva - AliExpress

Masajeador anticelulítico para terapia de crioterapia, máquina de congelación de Lipo Abdominal, pérdida de grasa, adelgazamiento corporal, Criolipolisis - AliExpress